What do we have at home? The assets of Peruvian households – Hugo Ñopo (translation)

Article written by Hugo Ñopo, Ph.D. in Economics from Northwestern University and Principal Investigator of GRADE

The pandemic has provoked renewed interest in some fundamental issues in the measurement of our economic development. One of these new interests is household asset tenure and the multidimensionality of poverty. Since 1998, Javier Escobal, Jaime Saavedra and Máximo Torero pointed out in their work on the assets of the poor in Peru that “… in the case of public services, although average access has been increasing, inequality levels continue to be very high. Furthermore, access to credit is highly differentiated according to spending quintiles, while financial savings and durable goods, which are assets that can serve as collaterals, are among the least distributed assets.” It is interesting to note that after 22 years there is still progress to be made and various challenges are still pending.

Currently, households access a broader array of services. The Encuesta Nacional de Hogares 2019 (ENAHO) identifies that 36% of Peruvian households have Internet access and 38% have satellite or cable television. However, inequality in access and its correlation with household incomes is striking. In addition to this, almost one in five households in the country does not have access to a public safe drinking water network within their home (here, also, the poorest). This is a particularly relevant limitation to face during the current pandemic. Nonetheless, the ENAHO itself allows us to identify achievements. Today almost all households in the country have a cell phone (92% in 2019, while only 16% in 2004) and have street lighting on their streets (96% in 2019, while fifteen years ago it reached 76 %).

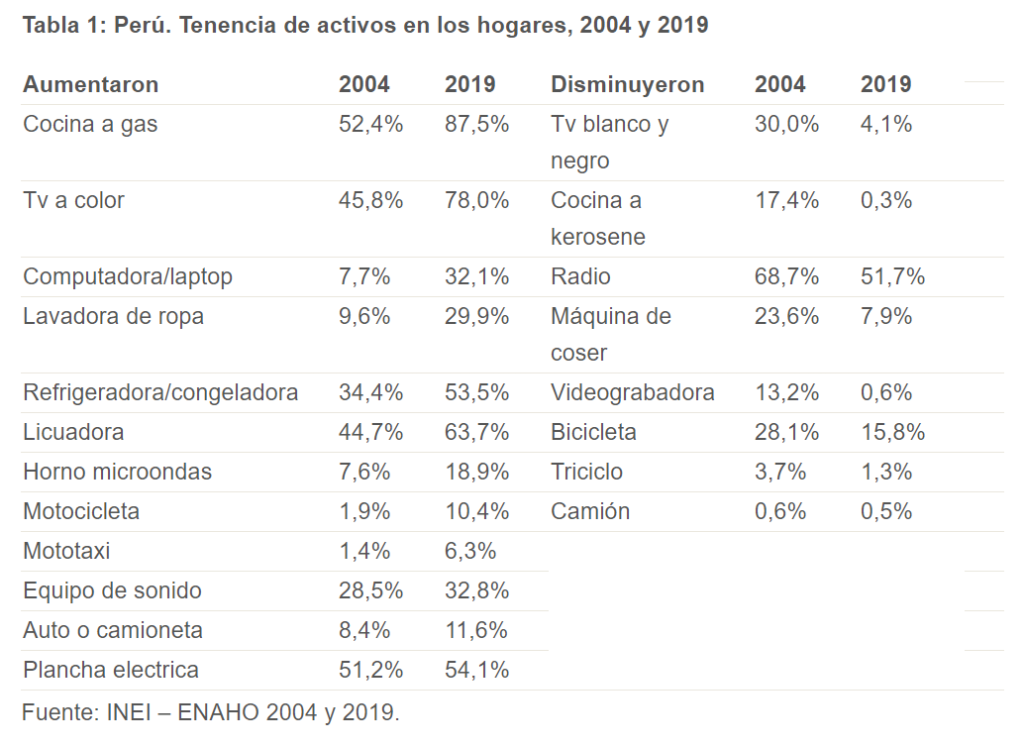

A comparison between 2004 and 2019 ENAHO’s data allows us to identify changes in goods and services in our homes. In these 15 years, our tenure of gas stoves, blenders and color televisions has increased significantly. At the same time, with the development of technologies, our ownership of black and white televisions, radios, kerosene stoves, sewing machines, and others has fallen (Table 1).

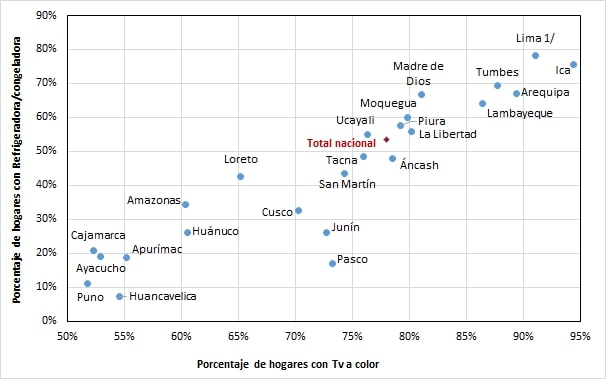

Part of the recent discussion has focused on owning refrigerators. In the circumstances of this pandemic, we need Peruvian households not to go out as often to shop in the markets. However, this is difficult because almost half the homes in the country do not have a refrigerator. This contrasts with the very high tenure we have of color televisions. In all regions of the country, there are more households with televisions than with refrigerators (Figure 1).

Figure 1

At first glance, data presented leads to the following question: Are we a country that prefers circus over bread? A simple answer to this question might be “yes”, but it is worth taking this opportunity to analyze the economic rationale of households. Here is a list of reasons that could make sense of this difference in asset ownership:

- Purchase price. Refrigerators are generally more expensive than televisions.

- Usage price. Refrigerators need to work 24/7, causing high expenses in electricity. TVs, in contrast, do not consume electricity all the time and their consumption in kilowatt-hours is 50% lower.

- Usage price. To use refrigerators, it is necessary to buy food beforehand, not in the case of the TV. For households that live on a daily basis income this is an important limitation.

- Logistics. In a significant percentage of houses, especially in the poorest ones, there is no 24/7 electricity to use a refrigerator.

- Market value. TVs can be pawned or sold with ease if necessary. This is an important reason among the poor because they do not save using financial instruments but rather they do it by investing in work materials or assets for their home.

- Practicality. A refrigerator is impractical for low-income households.

- Practicality. In small households, with one or two members, it is more practical not to cook (and therefore not to store food, also saving on gas).

- Rentals. Several landlords rent houses / rooms under the condition of no electrodomestic use with exceptions to TVs.

- Practical uses. TV is often the babysitter at home, especially in single parenting homes or where both parents work.

- Gastronomic culture. We generally place a high value on fresh food, and rightly or wrongly, we have beliefs that lead us to undervalue frozen food.

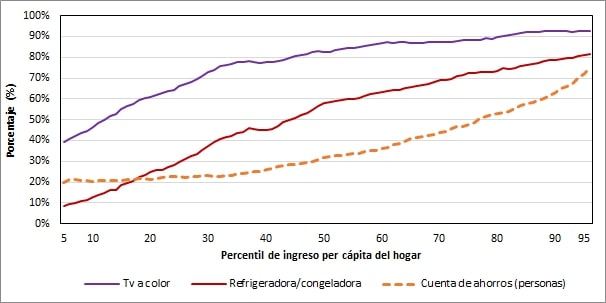

Thus, it seems that “poor but rational” or restricted optimization explanations in scarce contexts make more sense than simplistic stigmatization. Beyond the comparison of ownership of refrigerators with those of color televisions, there is another comparison that worries and is important in the context of this pandemic as well: the possession of bank accounts. Access to this service is even lower than the ownership of refrigerators in the country (Figure 2).

Figure 2

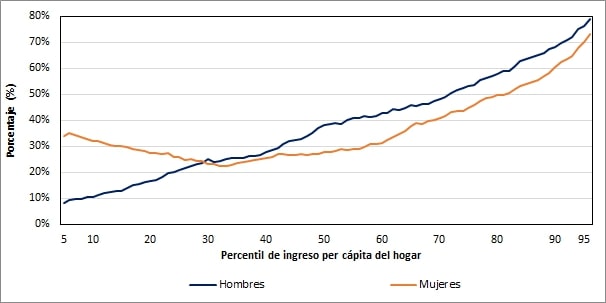

Just as it is possible to draft a list of reasons why Peruvian households have fewer refrigerators than televisions, it is also possible to prepare a list of reasons for Peruvians having such low financial inclusion. A first fact worth sharing is the gender gap that exists. In households in the first three income deciles, women have more bank accounts than men, in the other deciles the opposite is true.

A first explanation to this phenomena is Juntos program, which periodically transfers money to the country’s poor households. This transfer is made electronically to bank accounts designated by women in the households. This is consistent with the increased account tenure among women, but it fails to explain the whole phenomenon: Juntos reach only about 8% of the country’s households. Something else must be happening. Exploring the economic rationale behind these phenomena is a starting step on the road to promoting greater financial inclusion in the country. Hopefully we will soon see contributions to understand this in a better way to inform the proposed solutions. Recent successful experience has been the expansion of mobile phone technology. It is worth understanding this also with a dual purpose: What elements of such an expansion would be replicable for financial inclusion? To what extent can financial inclusion make use of the expansion of mobile phone technologies that already reaches almost every home?

Figure 3